Losing a loved one can be the most difficult experience you will face, and can make the thought of paperwork and administration all but impossible to deal with. At LHD Lawyers, we’re here to navigate you through this difficult time and help you receive the benefits you’re entitled to.

What is a superannuation death benefit claim?

A Death Benefit may be an entitlement that the nominated legal representative or beneficiary (as listed of a deceased person’s Superannuation policy) can receive after a person dies.

When someone passes away, their superannuation doesn’t simply disappear. Instead, it is paid out to a nominated beneficiary or next of kin. A superannuation death benefit claim will pay out any money held in the super account of your loved one after they pass away, plus any payments from their associated insurance policies. Your loved one can nominate in advance who receives their superannuation in the event of their death, but if they haven’t, their super will be distributed according to their will or transferred to their dependents.

Who can receive superannuation death benefits?

If you make a Binding Death Benefit Nomination, you can nominate whoever you want to receive your superannuation benefits in the event of your death. However, if a Non-binding Nomination has been made, benefits can go to:

- Your spouse or defacto

- The administrator of your estate

- Your children (it doesn’t matter how old)

- Someone who lived with you, or personally or financially cared for you

An example of a death benefit payout

Superannuation funds provide a range of benefits to their members, including death benefits. These benefits can provide financial assistance to the dependents of a member in the event of their death.

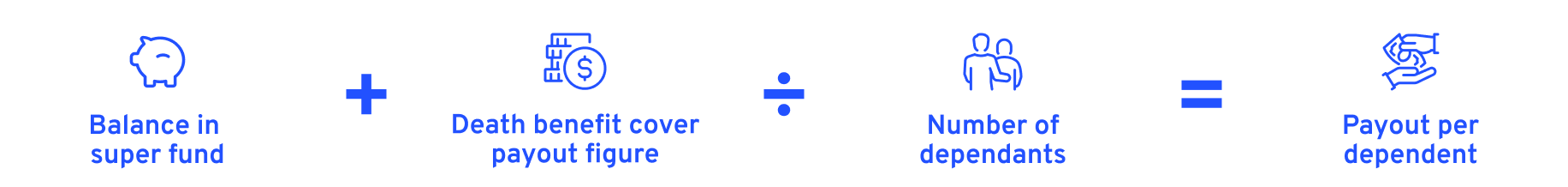

An example of the calculation of a standard payout to dependents is below:

The calculation of a death benefit in Australia can be complex and depends on a range of factors, including the size of the superannuation balance, the number and financial dependency of dependents, and any tax implications. It’s important to seek advice from a financial advisor or lawyer.

Find out more about how a claim is calculated in this article.

Meet our Specialist TPD Lawyers

FAQs

How is a superannuation death benefit calculated?

The calculation of a death benefit depends on various factors, including:

- The terms and conditions of the superannuation fund.

- The total number of years the deceased worked.

- The deceased’s final salary.

- Whether super fund’s insurer provides any life insurance proceeds.

- The circumstances of the beneficiaries (e.g. in some cases, payment may be subject to taxation – while tax dependents and children under 18 will not be subject to tax for a lump sum benefit, other non-dependent parties may be).*

It’s important to note that each superannuation fund can have different terms and conditions, so it’s best to check with the provider for details on how a death benefit will be calculated in your case.

Do all superannuation funds have a death benefit?

Yes, all superannuation funds in Australia are required by law to provide a death benefit to a deceased member’s beneficiaries.

How are death benefits paid out?

In Australia, death benefits from superannuation funds can be paid out in different ways, depending on the terms of the fund, as well as the preferences of the beneficiaries.

Typically, a superannuation death benefit is paid out of the deceased’s superannuation account as a lump sum payment or an income stream.

If the deceased has a binding death benefit nomination (written direction on how they want their benefits distributed) in place, the payment will typically be made according to the terms of the nomination.

How long after death can you apply for a superannuation death benefit?

In Australia, there is no set time frame for applying for a superannuation death benefit after the death of a superannuation member. Although the sooner you make the claim, the sooner you’ll receive the benefit.

Once the claim has been approved, it should be paid within five working days.

What is required to make a superannuation death benefit claim?

The trustee of the superannuation fund will typically require a certified copy of the deceased’s death certificate, as well as other identifying information for the beneficiaries. They may also require proof of your relationship to the deceased, such as a marriage certificate or birth certificate.

Can pensioners receive a superannuation death benefit?

Yes, so long as the pensioner fits the eligibility criteria, they can receive the benefit.

What’s the process for applying for a superannuation death benefit?

The process for applying for a death benefit can vary depending on the superannuation fund, so it’s best to check with the provider for specific details on what is required and the time frame for making a claim.

A superannuation fund may also be able to provide guidance and assistance throughout the process.

What are some other types of death benefits?

Aside from the superannuation death benefit, there are other death benefits available, which you may be eligible for:

- Bereavement Payment: This is a one-off lump sum payment to eligible partners or dependants of people receiving certain payments from Centrelink or the Department of Veterans’ Affairs at the time of death.

- Age Pension: In this case, the surviving partner of a pensioner who was receiving the Age Pension may be eligible for a higher rate of Age Pension for a limited period following the pensioner’s death.

- Department of Veterans’ Affairs Death Benefits: Dependents of a veteran who were receiving a pension from the Department of Veterans’ Affairs may be eligible for a range of death benefits, including a bereavement payment, ongoing support and funeral expenses.

- Life Insurance: Some life insurance policies provide a lump sum payment to the beneficiaries of the policyholder in the event of their death.

Eligibility for these death benefits and the amount of the benefit will depend on individual circumstances and policy details.

How are death benefits paid out?

In Australia, death benefits from superannuation funds can be paid out in different ways, depending on the terms of the fund, as well as the preferences of the beneficiaries.

Typically, a superannuation death benefit is paid out of the deceased’s superannuation account as a lump sum payment or an income stream.

If the deceased has a binding death benefit nomination (written direction on how they want their benefits distributed) in place, the payment will typically be made according to the terms of the nomination.

Does Centrelink pay a death benefit?

Yes, Centrelink provides a death benefit to eligible recipients in the form of a Bereavement Payment. The Bereavement Payment is a one-off lump sum payment to help with immediate expenses when someone close to you dies.

Contact Centrelink to find out if you’re eligible.

Make a superannuation death benefit claim today

LHD Lawyers helps everyday Australians receive the benefits they’re entitled to. Find out more about superannuation death benefits or call 1800 455 725 for a no-obligation consultation about your case.

We’re here to help

Contact us today for free online claim checker and we can help get your life back on track.